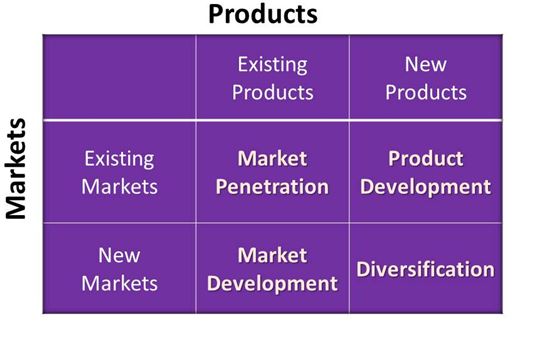

The Ansoff Matrix – Understanding Growth Strategies

I am sure many of you are familiar with the Ansoff Matrix. It is a simple strategic planning tool aimed at understanding generic strategies for growing a business via existing or new products in existing or new markets. The 2*2 matrix was presented by Igor Ansoff in his 1957 article in HBR and is still very popular.

This is how the Ansoff Matrix looks like:

* Market Penetration

In a market penetration strategy, a company tries to grow by using its existing products and services in existing markets. That is, it tries to grow by gaining market share in its existing markets. This can be done in two ways:

- Selling more of the products or services to current consumers – increasing depth of consumption.

- Finding new consumers in existing markets – increasing width of consumption.

There are various ways in which depth and width of consumption could be achieved:

- Reducing prices

- Increasing budgets on advertising and promotions

- Improving distribution

- Launching introductory/small packs

- Making minor product modifications

- Acquiring brands from competitors

* Market Development

In a market development strategy, a company aims to expand into new markets using its existing products and services. New markets could be within a country or they could be markets in other countries. They could also be new consumer segments that have not tapped hitherto.

Of course, in a market development strategy, a company would need to determine whether its products or services would be acceptable in new markets or segments; it would also need to gauge the strength of the competition and the likely costs and profitability scenarios in moving to new markets.

* Product Development

In a product development strategy, a company aims to create new products and services targeted at its existing markets.

In this strategy, a company would need to invest in R&D to develop new offerings. It would also need to ascertain the likely success of the new offering or offerings.

* Diversification

In a diversification strategy, a company aims to grow by introducing new products into new markets. Diversification is the most risky strategy of the four Ansoff generic strategies because on both the products and the markets, a company is on unfamiliar ground. A lot of preliminary research and development work needs to be done. Also, diversification is likely to be costly and a company needs to look at the financial resources and risks. Many multinational and national companies – the so called conglomerates – have grown via diversification and run businesses that are unrelated to each other.

The Ansoff Matrix has many advantages: (a) It is very simple to use; (b) It helps managers in analysing the current situation of a company and in setting clear growth objectives for the future; and (c) Depending on where a company is today, it does provide some immediate directions for growth (as outlined above in Market Penetration).

The problem with the Ansoff Matrix is that it does not take into account the external environment or other factors that could have a critical bearing in determining a cogent strategy.

However, what we must remember is that the matrix is not meant to be a complete tool; other analyses will need to be done by a company before embarking on a growth strategy. However, its simplicity and the outlining of the four generic growth strategies are its biggest strengths and that is how managers should view it.

Visual courtesy: https://www.flickr.com/photos/nikonvscanon/